How Blockchain Technology Works: A Deep Dive into its Mechanics

Introduction to Blockchain Technology

Blockchain technology, often heralded as a revolutionary advancement in the digital age, is fundamentally a decentralized ledger that records transactions across multiple computers. Its origins can be traced back to 2008 when a person or group using the pseudonym Satoshi Nakamoto introduced Bitcoin, the first and most well-known application of blockchain technology. This innovation emerged as a response to financial crises and growing concerns over the centralization of financial systems.

The basic principle of blockchain involves a chain of blocks, where each block contains a list of transactions. These blocks are linked using cryptographic hashes, ensuring the integrity and immutability of the data. The decentralized nature of blockchain means that no single entity has control over the entire network, thereby enhancing security and reducing the potential for fraud.

Over time, blockchain technology has evolved, expanding beyond its initial application in cryptocurrencies. It has found significant utility in various industries, from supply chain management and healthcare to finance and real estate. For instance, in the supply chain sector, blockchain can track the provenance of goods, ensuring transparency and reducing the likelihood of counterfeiting. In healthcare, it offers secure and efficient methods for managing patient records.

The importance of blockchain technology lies in its potential to transform traditional systems by introducing transparency, efficiency, and security. Its impact is already profound, with numerous enterprises and startups leveraging blockchain to innovate and solve complex problems. As we continue to explore the intricacies of blockchain, it is crucial to understand its foundational principles and historical context. This knowledge not only enriches our comprehension but also equips us to better navigate the future landscape shaped by this groundbreaking technology.

The Structure of a Blockchain

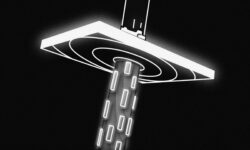

Understanding the fundamental structure of a blockchain is crucial to comprehending how this innovative technology operates. At its core, a blockchain is a distributed ledger that is composed of a series of blocks. Each block contains a list of transactions and forms a critical piece of the chain. Specifically, a block includes various components: a block header, transaction data, and metadata that ensures the integrity and security of the blockchain.

Each block’s header contains a timestamp, a cryptographic hash of the previous block, a unique nonce, and a Merkle root that summarizes all transactions within the block. The cryptographic hash links the current block to the previous one, thereby constructing a continuous chain. This linking is pivotal as it ensures that if any piece of data within a block is altered, its hash will also change, breaking the chain and alerting the network to tampering. This is what makes blockchain technology inherently immutable and secure.

Blocks are added to the chain in linear, chronological order through a process called mining in Proof of Work (PoW) consensus mechanisms, or through validation in Proof of Stake (PoS) systems. In either system, nodes must reach a consensus that the new block is valid before it is attached to the chain. This consensus ensures coherence and stability within the blockchain network.

Nodes, which are the individual computers that participate in the network, play a crucial role. Nodes store, spread, and validate the blockchain data, facilitating the decentralized nature of the system. Each node maintains a copy of the entire blockchain, ensuring there is no single point of failure. When a new block is proposed, nodes verify the authenticity of its transactions. If validated, the block is added to their copy of the blockchain, and the updated blockchain is propagated to all nodes in the network.

The combination of blocks, chains, and nodes forms an intricate and robust structure that underpins blockchain technology. By ensuring the integrity, transparency, and security of data, this structure enables the groundbreaking potential of blockchain across various applications.

How Transactions are Processed

At the heart of blockchain technology lies the intricate process by which transactions are handled. This begins when a user initiates a transaction on the blockchain network. Each transaction must be signed digitally by the user, ensuring authenticity and integrity. These digital signatures utilize cryptographic algorithms that link the transaction to the user’s private key, making it nearly impossible to alter the transaction without detection.

Once initiated, a transaction enters the blockchain network where it waits to be validated. This stage involves the process of hashing, where a unique hash value is generated for the transaction. Hashing acts as a digital fingerprint, converting transaction data into a fixed-length string of characters, regardless of the original data size. This ensures both security and anonymity, as each transaction hash is unique and irreversible.

The validation of transactions is a critical step and is carried out by nodes in the network. Nodes are individual devices on the network tasked with verifying the accuracy of transactions. These nodes employ consensus mechanisms to agree on the validity of the transaction. Various consensus algorithms exist, with Proof of Work (PoW) and Proof of Stake (PoS) being among the most widely adopted. In PoW, miners compete to solve complex mathematical problems, and the first to solve it gets to add the block to the chain. PoS, on the other hand, requires validators to hold and lock up a certain amount of cryptocurrency to ensure network security.

After achieving consensus, the validated transaction gets recorded onto a new block in the ledger. Each block contains a list of transactions and is cryptographically linked to the previous block, creating a chain of blocks — hence the name ‘blockchain.’ This linked chain provides an immutable and transparent record of all transactions ever processed by the network, reinforcing trust and reliability in the system.

Ultimately, it is through this meticulous process of transaction initiation, validation, and recording, utilizing advanced cryptographic principles and consensus algorithms, that blockchain technology ensures the security and integrity of its decentralized ledger.

Consensus Mechanisms: Proof of Work and Proof of Stake

Blockchain technology relies heavily on consensus mechanisms to uphold the integrity and security of the network. Among the primary methods, Proof of Work (PoW) and Proof of Stake (PoS) stand out, each having distinctive operational attributes and implications for scalability.

Proof of Work, the pioneering consensus mechanism, underpins the functionality of many prominent blockchains, including Bitcoin. It hinges on the process of mining, which necessitates computational power to solve complex mathematical puzzles. Miners, competing to solve these puzzles, expend considerable energy and resources; the first to solve it gets to add a new block to the blockchain and is rewarded with cryptocurrency. This method is lauded for its security benefits, as the sheer computational difficulty deters malicious actors from altering the blockchain’s history. However, PoW’s rigorous energy demands pose substantial environmental concerns and scalability issues, often resulting in slower transaction processing times.

Conversely, Proof of Stake offers an alternative approach by selecting validators in accordance with the quantity of cryptocurrency they are willing to ‘stake’ or lock up as collateral. This paradigm shift eliminates the need for energy-intensive computations. Validators are chosen to forge the subsequent block based on the size and age of their stake, promoting energy efficiency and faster transaction times. Nevertheless, PoS is not devoid of drawbacks. Critics argue that it could inadvertently centralize power, as wealthier participants with larger stakes have increased probability of being selected, potentially compromising the network’s decentralization and long-term security.

Each mechanism—Proof of Work and Proof of Stake—brings distinct advantages and limitations to the blockchain environment. While PoW emphasizes robust security at the cost of energy efficiency and speed, PoS offers a more sustainable and scalable solution but may introduce new centralization risks. Understanding these methods is crucial for comprehending the trade-offs and design considerations in blockchain technology.

Blockchain Security and Immutability

Blockchain technology is often heralded for its unparalleled security and immutability. At its core, the security of a blockchain stems from its decentralized nature and the use of advanced cryptographic techniques. These cryptographic methods ensure that data within a blockchain is both secure and tamper-proof. Each piece of data, or transaction, is encoded and connected to other transactions through a process known as hashing. This creates a unique, fixed-size hash value that represents the data, ensuring its integrity and confidentiality.

The decentralized nature of blockchain is another pillar of its security. Rather than relying on a central authority, blockchain operates on a distributed network of computers, known as nodes. Each node maintains an exact copy of the entire blockchain, making it incredibly difficult for any single entity to alter or manipulate the data. For a change to be made, it would need to be approved by a consensus of the network, which is inherently resistant to tampering due to the sheer number of participants involved.

Immutability is a fundamental feature of blockchain technology. Once data is recorded onto a blockchain, it cannot be altered or deleted. This permanence is ensured by the interconnected structure of blocks in the chain. Each new block contains a hash of the previous block, forming an unbreakable chain of historical data. To alter any single transaction, one would need to modify all subsequent blocks, a computationally impractical task given the decentralized and distributed nature of the network.

There have been very few instances of security breaches within established blockchain networks, further underscoring their robustness. For example, the Bitcoin blockchain, the most well-known and widely-used blockchain network, has never been successfully compromised in its over a decade-long history. This track record serves as a testament to the reliability and security of the underlying blockchain technology.

In conclusion, the combination of cryptographic techniques, decentralization, and the inherent immutability of blockchain data renders this technology exceptionally secure. These features collectively contribute to an environment where data integrity and security are both preserved, setting blockchain apart as a groundbreaking solution for secure data management.

Transparency and Decentralization

Blockchain technology is revered for its ability to ensure outstanding transparency and decentralization. At its core, blockchain operates on a decentralized ledger system, a fundamental aspect that sets it apart from traditional centralized systems. This decentralized nature is achieved by a network of nodes, each holding a copy of the ledger. These distributed networks work in consensus to validate transactions, eliminating the need for a central authority that single-handedly controls data verification.

The transparency of blockchain stems from the public accessibility of its transaction logs. Unlike conventional databases, where access is typically restricted, blockchain ledgers are openly available to anyone within the network. Every transaction, once recorded, is immutable and visible to all participants. This public ledger system enhances trust and accountability, as anyone can verify the authenticity and sequence of transactions without relying on a centralized entity.

Decentralization plays a pivotal role in ensuring the robustness and security of the blockchain. In a centralized system, a single point of control increases the risk of failure, corruption, or malicious attacks. However, in a blockchain, the responsibility is distributed across numerous nodes, making it highly resilient to such threats. The consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), require a majority agreement among nodes, further fortifying the security and integrity of the ledger.

Moreover, decentralization facilitates a democratized digital environment. This means that no single entity has overarching control over the entire blockchain. Decisions are made collectively by the network participants, fostering a more inclusive and participatory system. Decentralization also mitigates the risk of power abuse or unfair manipulation, as control is evenly distributed. As more industries and sectors explore blockchain, its decentralized framework ensures a higher degree of trust, transparency, and reliability.

Smart Contracts and Their Applications

Smart contracts are self-executing contracts where the terms between buyer and seller are directly written into lines of code. These contracts reside on a blockchain, ensuring that once conditions are met, the outcomes are automatically enforced without the need for intermediaries. The blockchain serves as a decentralized ledger, making the execution of smart contracts transparent, traceable, and irreversible.

These digital protocols run on blockchain platforms such as Ethereum, which popularized the concept. Smart contracts are executed through a series of if-then statements coded in them. For instance, in a financial transaction, if the payment is received, the ownership of a digital asset is automatically transferred to the buyer. This automation eliminates the need for third parties, reducing costs and potential delays.

The advantages of smart contracts are manifold. Due to their self-executing nature, they ensure automation, minimize human error, and enhance security. The lack of intermediaries also translates to reduced transaction fees and quicker settlement times. Furthermore, because smart contracts are stored on a blockchain, they benefit from the immutable and transparent nature of this technology, thereby providing an additional layer of security and trust.

Smart contracts have a wide array of applications across various industries. In finance, they can revolutionize loan agreements by automatically enforcing repayment schedules and releasing collateral once loans are paid off. The supply chain sector can benefit from enhanced tracking and verification of goods, ensuring that products meet specific criteria before moving to the next stage. Real estate transactions, often bogged down by paperwork and intermediaries, can be streamlined with smart contracts, enabling automatic transfers of property once agreed conditions are met.

In conclusion, by leveraging the automation and trustless nature of blockchain technology, smart contracts stand poised to transform numerous industries, making transactions more efficient, secure, and cost-effective.

The Future of Blockchain Technology

As the digital landscape evolves, blockchain technology stands poised to revolutionize numerous sectors. Despite its current challenges, such as scalability, energy consumption, and regulatory uncertainties, innovative solutions are steadily emerging. For instance, the development of consensus algorithms like Proof-of-Stake aims to mitigate the energy demands criticized in traditional Proof-of-Work systems. Additionally, Layer 2 technologies are being explored to enhance blockchain scalability, increasing transaction throughput without sacrificing security and decentralization.

Another significant trend is the integration of blockchain with other cutting-edge technologies. The synthesis of blockchain and artificial intelligence promises to unlock unprecedented potential for data security and transactional efficiency. Furthermore, the convergence of blockchain with the Internet of Things (IoT) is expected to streamline and secure interactions between interconnected devices, thereby unlocking new realms of automation and smart technology.

In the sphere of finance, decentralized finance (DeFi) represents a burgeoning area of blockchain application. By enabling financial activities such as lending, trading, and insurance through decentralized protocols, blockchain is disrupting traditional financial systems. This trend is likely to continue, with the potential to democratize access to financial services on a global scale. Blockchain’s immutable ledger is also gaining traction in supply chain management, providing transparency and traceability from production to delivery, which is crucial for industries like pharmaceuticals and food safety.

Industry experts speculate that blockchain’s role in the future digital economy will be profound. As regulatory frameworks become more refined, we can anticipate greater mainstream adoption of blockchain-based solutions. Innovations such as Central Bank Digital Currencies (CBDCs) illustrate how governments are beginning to embrace blockchain technology to enhance financial systems. Furthermore, ongoing developments in smart contracts could streamline legal agreements and business processes, reducing administrative overheads and fostering greater efficiency.

The ongoing advancements and strategic integrations suggest a promising trajectory for blockchain technology. While challenges remain, the collective progress in addressing these issues foretells a dynamic and influential future for blockchain in various facets of the digital economy.