How to Keep Your Crypto Assets Secure: Tips and Best Practices

Understanding the Basics of Crypto Security

Securing your cryptocurrency assets begins with understanding how cryptocurrencies operate and the potential threats you may face. Cryptocurrencies, like Bitcoin and Ethereum, operate on decentralized networks using blockchain technology. This decentralization means that transactions are verified by a network of nodes rather than a central authority. However, the decentralized nature does not make cryptocurrency wallets impervious to threats.

Common threats to crypto security include phishing attacks, malware, and social engineering tactics designed to trick users into revealing their private keys. Private keys are essentially your digital signatures, providing access to your assets stored on the blockchain. If someone gains access to your private keys, they can control your digital assets. Therefore, understanding and protecting your private keys is paramount in maintaining the security of your crypto assets.

The importance of a security-first mindset cannot be overstated. Adopting robust security practices from the outset minimizes the risk of unauthorized access to your digital assets. This includes using complex, unique passwords for your crypto exchanges and wallet applications, enabling two-factor authentication (2FA), and being vigilant about suspicious emails or links that may be attempts to steal your keys or login information. Educating yourself about the various methods attackers use, such as phishing and keylogging, can further enhance your defensive measures.

Moreover, cryptographic security plays a crucial role in protecting digital assets. This technology ensures the integrity and confidentiality of your transactions on the blockchain. Encryption methods such as public and private keys provide a secure way to manage and transfer your crypto assets. Employing hardware wallets, which store your private keys offline, adds another layer of security by significantly reducing the risk of online threats.

Utilizing Hardware Wallets for Maximum Security

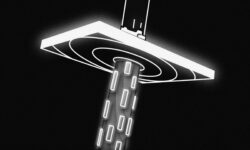

The importance of securing cryptocurrency cannot be overstated, and one of the most effective measures is the use of hardware wallets. Hardware wallets are physical devices designed to isolate your private keys from internet-connected devices, thereby safeguarding your digital assets from online hacks and malware attacks.

By storing private keys offline, hardware wallets ensure that even if your computer is compromised, your crypto assets remain secure. Unlike software wallets, which can be vulnerable to cyber threats, hardware wallets provide an extra layer of security by keeping your credentials away from prying eyes and potential intrusions.

Several reputable hardware wallets are available on the market, each offering unique features to cater to different user needs. For instance, the Ledger Nano S and Ledger Nano X are renowned for their robust security and extensive compatibility with various cryptocurrencies. On the other hand, the Trezor One and Trezor Model T are also highly regarded, offering user-friendly interfaces and top-tier encryption capabilities. These devices support a wide range of coins and tokens, making them versatile options for cryptocurrency enthusiasts.

Setting up a hardware wallet generally involves straightforward steps. First, you need to initialize the device, usually by connecting it to a computer or smartphone via USB or Bluetooth. Upon initialization, the device generates a set of private keys and provides a unique recovery seed phrase. It is crucial to securely store this seed phrase, as it serves as a backup to recover your funds if the wallet is lost or damaged. Avoid storing the recovery phrase digitally; instead, write it down and keep it in a safe location.

After setup, you can manage your cryptocurrency transactions through the wallet’s dedicated application. Always ensure that you download software and firmware updates directly from the manufacturer’s official website to mitigate the risk of counterfeit products and malware.

In conclusion, hardware wallets represent a pinnacle of security for crypto asset storage. By taking your private keys offline, they offer a highly secure environment for managing your digital funds. Adopting the appropriate hardware wallet and following best practices for setup and use can significantly enhance the security of your cryptocurrency holdings.

Implementing Two-Factor Authentication and Strong Passwords

In an era when cyber threats are ubiquitous, strengthening the security of your crypto assets is paramount. Two-factor authentication (2FA) and the use of strong passwords are two pivotal measures that can significantly bolster your account protection. Two-factor authentication is a method that requires not just your password, but also a second form of verification before you can access your account. This additional layer of security could be a code sent to your mobile device, a biometric scan, or even a hardware token. By necessitating two forms of authentication, you add a formidable obstacle for potential hackers, making unauthorized access to your crypto exchange or wallet accounts exceedingly difficult.

The importance of 2FA in securing your crypto assets cannot be overstated. Cybercriminals often exploit vulnerabilities within systems where single-layer authentication is employed. With 2FA, even if an attacker manages to obtain your password through phishing or other means, they would still require the second form of verification, effectively thwarting many common cyber-attack methods. Therefore, enabling 2FA on all your accounts that hold or manage crypto assets is highly recommended.

Equally crucial is the practice of using strong, unique passwords. A strong password typically consists of a combination of upper and lower-case letters, numbers, and special characters. Avoid common words, phrases, and easily guessable information such as birthdays or names. It’s also imperative that each of your accounts has a unique password. Re-using the same password across multiple accounts exposes you to greater risk; if one account is compromised, others could easily follow.

Managing strong, unique passwords might seem daunting, but password managers offer a practical solution. These tools can generate complex passwords and store them securely, allowing you to manage multiple accounts with ease. With a password manager, you need only remember a single master password to access your vault of stored passwords. This approach not only enhances security but also improves convenience.

Recognizing and Avoiding Common Crypto Scams

Navigating the dynamic world of cryptocurrencies requires vigilance, especially with the growing presence of crypto-related scams. Understanding and avoiding these scams is critical to maintaining the security of your crypto assets. Several prevalent types of scams include phishing scams, Ponzi schemes, fake Initial Coin Offerings (ICOs), and social engineering attacks.

Phishing scams leverage fraudulent websites or communications, imitating legitimate entities to trick individuals into divulging sensitive information. These attacks often come through emails or social media messages that contain a link to a fake website resembling a real crypto exchange or wallet provider. To avoid falling victim, always double-check the URL for any inconsistencies and ensure that the communication originates from a verified source before clicking any links or entering personal information.

Ponzi schemes are fraudulent investment operations where returns for older investors are paid with the capital from new investors rather than legitimate profit. These scams often promise high returns with little to no risk. Red flags include guaranteed returns, overly consistent performance, and a lack of transparency about the investments. Always conduct thorough research and verify the credentials of the individuals and companies involved before making any investment.

Fake ICOs have become a popular method for scammers to exploit the crypto hype. These fake projects usually present a well-designed whitepaper and marketing materials to lure investors into buying a new cryptocurrency. To protect yourself, investigate the team behind the ICO, review the project’s technical details, and look for credible third-party reviews.

Social engineering attacks exploit human psychology to gain access to personal or financial information. These attacks often involve personalized messages or calls that create a sense of urgency or fear. To prevent falling victim, be wary of unsolicited communications and never disclose private information or transfer funds under pressure.

A cautious and critical approach is essential when dealing with potentially lucrative opportunities in the crypto space. Verify the legitimacy of investment opportunities by checking multiple credible sources. Recognize red flags such as unrealistic promises, lack of transparency, and unofficial communication channels. Maintaining a healthy skepticism can safeguard your crypto assets against ever-evolving threats.

Good

Bagus sekali informasi nya… Beruntung saya membacanya