Introduction to Cryptocurrencies: An Overview

Understanding Cryptocurrencies: Definition and Key Concepts

Cryptocurrencies, often referred to as digital or virtual currencies, represent a revolutionary shift in the global financial landscape. At their core, cryptocurrencies are designed to function as a medium of exchange, akin to traditional money but entirely electronic. This novel approach is facilitated through decentralized computer networks, diverging fundamentally from the centralized mechanisms that characterize conventional financial systems.

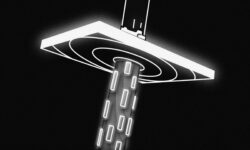

A defining attribute of cryptocurrencies is decentralization. Unlike traditional fiat currencies—which are typically regulated by central banks or governmental entities—cryptocurrencies operate on decentralized platforms. This decentralization is achieved through blockchain technology, ensuring that transactions are transparent, immutable, and secure. The blockchain is essentially a distributed ledger that records all transactions across a network of computers, making it resistant to tampering or fraud.

Another pivotal concept in the cryptocurrency realm is cryptographic security. This involves the use of cryptographic techniques to secure transactions and control the creation of new units. Cryptographic algorithms ensure that each transaction is authenticated and validated, offering a high level of security and trust without the need for intermediaries.

In contrast to traditional fiat currencies, which are government-issued and possess value because they are backed by governmental decree, cryptocurrencies derive their value from their network protocols, user adoption, and the computational work required to create them. Fiat currencies are subject to monetary policies and inflationary pressures, whereas cryptocurrencies typically have a predefined supply cap, providing a deflationary economic model.

Understanding these fundamental concepts is crucial for anyone looking to delve into the world of cryptocurrencies. From blockchain technology to cryptographic security, these elements form the backbone of what makes cryptocurrencies not only unique but also a potentially transformative force in modern finance.

How Cryptocurrencies Work: The Mechanisms Behind Digital Currencies

Cryptocurrencies represent a revolutionary shift in how digital assets are created, managed, and transferred. At the heart of these systems lies blockchain technology, a distributed ledger that ensures transparency, security, and decentralization. A blockchain is essentially a chain of blocks, each containing a list of transactions. When a new transaction occurs, it is grouped into a block with other transactions, verified by the network, and added to the blockchain in a linear, chronological order.

The transparency and security of blockchain technology stem from its decentralized nature. Unlike traditional centralized systems, where a single entity has control, in a blockchain network, multiple participants validate transactions. This peer-to-peer network uses consensus algorithms to agree on the validity of transactions. Two popular consensus algorithms are proof of work (PoW) and proof of stake (PoS).

In a proof of work system, miners compete to solve complex mathematical puzzles, and the first one to solve it gets to add the new block to the blockchain and is rewarded with newly minted cryptocurrency. This process, known as mining, requires significant computational power and energy but ensures that the network remains secure and tamper-proof. On the other hand, proof of stake selects validators based on the number of coins they hold and are willing to “stake” as collateral. PoS is deemed more energy-efficient and scales better, addressing some limitations of PoW.

Transactions in a blockchain are verified by network participants before being recorded. Each participant, or node, keeps a copy of the blockchain, and changes made to one copy are instantly visible to all others. This decentralized verification process helps prevent fraud and double-spending.

Another critical aspect of cryptocurrencies is wallet management. Cryptocurrencies are stored in digital wallets, which hold the public and private keys necessary to carry out transactions. The public key functions like an address to send or receive funds, while the private key is a secure password that enables the spending of the cryptocurrencies. The security of these private keys is paramount; losing them means losing access to the cryptocurrencies they protect.

The Evolution and Variety of Cryptocurrencies

The inception of cryptocurrencies began with the introduction of Bitcoin in 2009 by an anonymous entity known as Satoshi Nakamoto. Bitcoin was the first decentralized cryptocurrency, laying the foundational framework for blockchain technology. Early adopters heralded it as a revolutionary leap towards a decentralized financial system, void of governmental and institutional control.

Bitcoin’s success spurred the creation of numerous alternative cryptocurrencies, commonly termed as altcoins. Among these, Ethereum stands out, launched in 2015 by a developers’ team including Vitalik Buterin. Distinguished by its pioneering smart contract functionality, Ethereum opened the gateway for more programmable and adaptable blockchain applications. This breakthrough enabled the development of decentralized applications (dApps) and fuelled the advent of decentralized finance (DeFi).

The DeFi movement has grown exponentially, emphasizing the importance of decentralized protocols that allow individuals to trade, lend, and borrow assets without intermediaries. Platforms like Uniswap, Compound, and Aave represent such innovations, each contributing to making financial systems more accessible and transparent.

Notably, the variety of cryptocurrencies continues to expand, showcasing a spectrum from stablecoins pegged to fiat currencies, such as Tether (USDT), to privacy-focused coins like Monero, which emphasize transactional anonymity. Memecoins like Dogecoin, initially created as a joke, have garnered significant attention and investment, demonstrating the unpredictable dynamics within the crypto sector.

The continuous innovation within the cryptocurrency space underscores its evolving nature. Developers and investors remain actively engaged in refining existing technologies and exploring novel applications. As the market progresses, it becomes increasingly clear that the cryptocurrency ecosystem is not only diversifying but also setting the stage for broader adoption and integration into modern financial systems.

Impact and Importance of Cryptocurrencies in the Modern Financial Ecosystem

Cryptocurrencies have progressively established themselves as a pivotal component of the modern financial ecosystem. Their adoption is increasingly prominent, especially as digital assets continue to attract investors, providing diverse avenues for portfolio diversification. By offering a decentralized financial mechanism, cryptocurrencies have become valuable assets for long-term investment, with many viewing them as a hedge against inflation due to their limited supply and deflationary characteristics.

Beyond investment, cryptocurrencies have significantly transformed the realm of remittances. Traditional remittance services often come with high fees and lengthy transfer times. Cryptocurrencies, on the other hand, enable faster and more cost-effective cross-border transactions. This has revolutionized how funds are sent and received globally, especially benefiting underbanked populations who lack access to conventional banking services.

Another critical dimension of cryptocurrencies is their potential to enhance financial inclusion. In regions where access to traditional banking is either limited or non-existent, cryptocurrencies offer an alternative means of engaging in financial activities. This democratization of finance allows individuals to participate in the global economy without the need for a bank account, thereby bridging significant financial gaps.

However, the growing use and reliance on cryptocurrencies bring about certain challenges and risks. Volatility remains one of the prime concerns, making stable valuation a recurring issue. This volatility can impact both investors and users, leading to potential financial instability. Moreover, the decentralized nature of cryptocurrencies poses regulatory challenges. Governments and financial institutions worldwide are grappling with how to effectively regulate these digital assets to prevent misuse, such as in illicit activities, while fostering innovation.

Looking ahead, the cryptocurrency market is poised for further evolution, with expected trends pointing towards greater institutional adoption, regulatory advancements, and technological improvements. Central bank digital currencies (CBDCs) and decentralized finance (DeFi) are likely to play significant roles in shaping the future landscape, offering new opportunities and paradigms in the financial world.

ssmssm