The Rise of Decentralized Finance (DeFi): A New Frontier in Global Finance

Introduction to Decentralized Finance (DeFi)

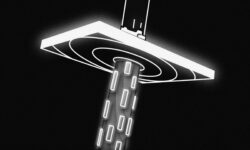

Decentralized Finance, commonly referred to as DeFi, is a revolutionary movement within the financial sector premised on removing intermediaries and central control. Originating from the blockchain technology that supports cryptocurrencies like Bitcoin and Ethereum, DeFi leverages smart contracts to create an open financial system. These smart contracts, which are self-executing contracts with the terms directly written into lines of code, enable peer-to-peer (P2P) transactions without the need for traditional financial institutions.

The genesis of DeFi can be traced back to the advent of Ethereum, which introduced smart contract functionality to the blockchain ecosystem. This innovation allowed developers to create decentralized applications (dApps) that run autonomously on a blockchain network. As a result, users can engage in financial activities such as lending, borrowing, trading, and investing directly with one another, bypassing conventional banks and brokers.

What sets DeFi apart from the traditional financial system is its transparency, security, and inclusivity. By operating on decentralized networks, DeFi platforms ensure that all transactions are publicly recorded on the blockchain, reducing the risk of fraud. Moreover, blockchain’s cryptographic security ensures the integrity and confidentiality of financial transactions. This decentralized approach democratizes access to financial services, particularly benefiting individuals in regions with underdeveloped banking infrastructure or those excluded from traditional financial systems.

The growing interest in DeFi is attributed to its potential to reform the financial landscape fundamentally. DeFi offers an alternative that empowers users with more control over their assets and financial decisions. With the ability to earn interest, invest in diverse assets, and access liquidity pools, DeFi presents new opportunities for financial innovation and inclusion. As the DeFi ecosystem continues to expand, it poses critical questions and challenges for traditional finance, regulators, and policymakers alike, making it a significant frontier in the evolution of global finance.

Traditional Finance vs. Decentralized Finance

As we navigate the evolving landscape of global finance, understanding the fundamental differences between traditional finance and decentralized finance (DeFi) becomes crucial. Traditional finance, or centralized finance, relies heavily on intermediaries such as banks, brokers, and regulatory bodies to facilitate transactions, maintain records, and ensure compliance with jurisdictional regulations. This centralized structure, while offering a measure of security and stability, often results in inefficiencies, delays, and higher costs for consumers.

Conversely, decentralized finance fundamentally transforms this dynamic by leveraging blockchain technology to eliminate intermediaries, thereby decentralizing the financial ecosystem. By replacing conventional banking structures with smart contracts and decentralized applications (dApps), DeFi offers a more transparent, accessible, and efficient system. One notable advantage of DeFi is its ability to provide financial services to unbanked or underbanked populations, alleviating barriers that have traditionally hindered access to essential financial products.

For instance, in traditional finance, if an individual wishes to obtain a loan, they must undergo a rigorous application process often associated with credit checks, income verifications, and potential biases. In DeFi, however, the same individual can obtain a loan through a decentralized lending platform using cryptocurrency as collateral, with smart contracts autonomously managing the terms and execution without a need for credit checks or lengthy approval processes.

Transparency is another pivotal distinction. Traditional finance operates within a framework where the inner workings are often opaque to the end-users. Financial institutions manage and oversee transactions, yet customers typically have limited visibility into these processes. On the contrary, the nature of blockchain technology ensures that every transaction within the DeFi ecosystem is recorded on a public ledger, accessible for anyone to audit and verify. This heightened level of transparency fosters trust and integrity within the system.

As this section underscores, the dichotomy between traditional finance and decentralized finance is marked by significant differences in structure, operation, and accessibility. The shift towards decentralized financial systems represents not just a technological evolution, but a profound redefining of financial inclusivity and efficiency.

Key Components of DeFi

Decentralized Finance, or DeFi, encompasses a diverse range of financial services and products enabled through blockchain technology. The foundation of DeFi lies in several key components that work cohesively to create an efficient and secure financial ecosystem. Understanding these components is crucial for grasping the full potential of DeFi.

One of the primary building blocks of DeFi is smart contracts. Smart contracts are self-executing contracts with the terms directly written into code. They operate on blockchain networks, such as Ethereum, and automatically enforce, verify, and execute an agreement when predetermined conditions are met. By eliminating intermediaries, smart contracts ensure transactions are transparent, immutable, and trustless, significantly reducing costs and enhancing efficiency.

Decentralized exchanges (DEXs) are another crucial aspect of DeFi. Unlike traditional exchanges, DEXs enable peer-to-peer trading of cryptocurrencies without the need for a central authority or intermediary. These exchanges utilize smart contracts to facilitate and automate transactions, providing users with greater control over their assets. Popular DEXs, such as Uniswap and SushiSwap, offer liquidity pools where users can lend their tokens to earn rewards, fostering a more inclusive and accessible financial market.

Lending platforms are integral to the DeFi ecosystem, allowing users to lend and borrow assets in a decentralized manner. Platforms like Compound and Aave enable users to deposit their crypto holdings into liquidity pools, earning interest over time. Conversely, borrowers can access these pools by depositing collateral to secure loans. This decentralized model provides more competitive interest rates and reduced barriers to entry compared to traditional banking systems.

Finally, stablecoins play a vital role in DeFi, offering stability in an otherwise volatile market. Stablecoins are pegged to fiat currencies like the US dollar, providing a reliable store of value and medium of exchange. Examples include Tether (USDT) and USD Coin (USDC). By offering stability and liquidity, stablecoins facilitate smoother and more predictable transactions within the DeFi ecosystem.

Together, these components form the backbone of DeFi, each element interlocking to create a robust, decentralized financial infrastructure. As the DeFi landscape continues to evolve, these components will likely introduce even more innovative solutions, reshaping the future of global finance.

Advantages of DeFi

Decentralized Finance (DeFi) offers a groundbreaking shift in the financial landscape by leveraging blockchain technology to democratize access to financial services. One of the most notable advantages of DeFi is its potential to increase financial inclusion. Traditional financial systems often exclude large segments of the population, particularly in developing regions. DeFi platforms, operating on decentralized networks, can be accessed by anyone with an internet connection, removing the barriers imposed by conventional banking systems.

Another significant benefit is the reduction of fees. Traditional banks and financial institutions typically impose a range of fees for their services, from transaction fees to maintenance charges. DeFi protocols operate with minimal intermediaries, directly linking users and reducing the costs associated with financial transactions. For example, Uniswap, a decentralized exchange, allows users to trade cryptocurrencies directly from their wallets without the need for an centralized exchange, effectively cutting down transaction costs.

Enhanced transparency is also a crucial advantage. DeFi applications run on blockchain technology, which inherently provides a transparent and immutable ledger of all transactions. Users can independently verify and audit the processes, which promotes higher levels of trust and security. For instance, Compound, a popular DeFi lending platform, offers complete visibility into its lending and borrowing activities, allowing participants to scrutinize and verify all logged activities and interest calculations.

The real-world impact of these advantages is already apparent. According to a report by the World Bank, nearly 1.7 billion people worldwide do not have access to a bank account. DeFi holds the promise to include this underbanked population within the financial ecosystem by offering accessible and affordable financial services. Additionally, data from DeFi Pulse illustrates the exponential growth of the DeFi market, with total value locked (TVL) surpassing $90 billion in 2021, reflecting heightened adoption and the effective reduction of transactional barriers.

Overall, the advantages of DeFi, from financial inclusion to cost efficiency and transparency, are reshaping the future of global finance. As DeFi continues to evolve, it promises to bring about more equitable financial solutions on a global scale.

Challenges and Risks of DeFi

Decentralized Finance (DeFi) is undoubtedly reshaping the landscape of global finance, yet it is not without its challenges and risks. One of the most pressing concerns in the DeFi space is security vulnerabilities. Recent high-profile hacks and smart contract breaches have resulted in significant financial losses. These incidents highlight the risks inherent in an ecosystem that relies heavily on code, where a single bug can lead to catastrophic outcomes. Despite rigorous audits and security protocols, the nascent stage of DeFi means that vulnerabilities can and do emerge, putting users’ funds at risk.

Another critical issue is regulatory uncertainties. DeFi operates in a largely unregulated environment, which can lead to various complications. On the one hand, this lack of regulation provides room for innovation and growth; on the other, it opens the door to fraudulent activities and scams. Governments and regulatory bodies are still grappling with how to approach and govern decentralized platforms. The absence of clear regulations can deter institutional investment and broader adoption, as potential participants remain wary of the legal ramifications.

Market volatility is also a significant risk factor in the DeFi sector. The rapid price fluctuations of cryptocurrencies, which underpin the majority of DeFi protocols, can result in substantial gains or devastating losses within short periods. This volatility poses a risk not only to individual investors but also to the stability of the entire DeFi ecosystem. Additionally, issues such as over-collateralization in lending protocols can exacerbate market swings, leading to liquidity crises.

Lastly, the user experience in DeFi platforms can be daunting for non-technical users. The complexity of interacting with wallets, understanding smart contracts, and managing private keys can be significant barriers to entry. Enhanced user education and more intuitive interfaces are essential for broader adoption.

While the potential benefits of DeFi are immense, it is crucial to acknowledge and address these challenges and risks to build a more robust and secure financial system.

Significant DeFi Projects and Innovations

Among the myriad of decentralized finance (DeFi) projects, a few have distinguished themselves through their innovative approaches and substantial contributions to the ecosystem. Leading the charge, Uniswap, Compound, and MakerDAO have each brought unique features that have significantly shaped the DeFi landscape.

Uniswap is a prominent decentralized exchange (DEX) that allows users to trade cryptocurrencies without the need for a traditional intermediary. Instead of relying on a standard order book system, Uniswap employs an automated market maker (AMM) model, which uses smart contracts to create liquidity pools. This model not only ensures constant liquidity but also democratizes trading, making it accessible to a broader range of users. With its user-friendly interface and efficient trading mechanisms, Uniswap has become a cornerstone in the DeFi arena.

Compound is another trailblazing DeFi project, renowned for pioneering the concept of decentralized lending and borrowing. Users can supply their crypto assets to liquidity pools, earning interest on their deposits. Conversely, borrowers can collateralize their crypto holdings to obtain loans without the need for credit checks. This transparent and automated system has greatly enhanced financial inclusivity, providing access to financial services to a global audience, previously excluded by traditional finance models.

MakerDAO, a decentralized autonomous organization, operates the Maker Protocol, which manages the stablecoin DAI. Unlike other cryptocurrencies, DAI is pegged to the US dollar, providing stability in the often volatile crypto market. MakerDAO enables users to lock ETH collateral in a smart contract to generate DAI, thus facilitating loans without traditional banks. This mechanism not only supports value stability but also supports a wide range of applications within the DeFi ecosystem, from savings and remittances to trading and investment.

Altogether, these projects exemplify the innovation and disruption characteristic of DeFi, each addressing specific challenges and opportunities. Their continued evolution not only highlights the dynamic nature of decentralized finance but also underscores its potential to redefine global financial systems.

The Potential Impact of DeFi on Global Finance

The advent of Decentralized Finance (DeFi) holds the promise of significant transformations in the global finance landscape. By leveraging blockchain technology, DeFi aims to create an open, trustless, and transparent financial system that could disrupt traditional financial institutions and reshape global markets. One of the primary implications is the democratization of financial services. DeFi platforms facilitate access to financial products like savings, loans, and insurance without reliance on centralized entities such as banks or intermediaries. This opens opportunities for individuals in underbanked regions, fostering greater financial inclusivity.

Financial institutions face both challenges and opportunities with the rise of DeFi. On one hand, they must contend with the erosion of traditional financial roles and income streams, such as fees from intermediaries. On the other hand, institutions have the potential to innovate by integrating DeFi technologies into their operations, thereby offering new, efficient financial solutions to customers. For instance, adopting smart contracts can reduce operational costs and enhance security across financial transactions.

The impact on global markets is equally profound. DeFi introduces a new paradigm where financial transactions can be executed 24/7, independent of traditional market hours and geographical boundaries. This constant liquidity and accessibility could lead to more dynamic and efficient markets. Furthermore, tokenization of assets allows for fractional ownership, enabling wider participation in investments, from real estate to complex financial instruments.

Individual users stand to benefit significantly from DeFi’s decentralized financial systems. By eliminating the need for intermediaries, DeFi reduces transaction costs and increases the speed of financial operations. Additionally, users have greater control over their assets, aligned with the ethos of self-sovereignty. However, it is crucial for users to understand the risks, such as smart contract vulnerabilities and regulatory uncertainties, associated with DeFi platforms.

In conclusion, DeFi’s potential impact on global finance is vast, encompassing the transformation of financial institutions, the evolution of global markets, and the empowerment of individual users. As this sector continues to mature, it will be essential to navigate both its opportunities and challenges to construct a more inclusive and efficient financial future.

Future Prospects of DeFi

The future of Decentralized Finance (DeFi) appears promising, driven by rapid technological advancements, increased adoption, and evolving regulatory landscapes. As DeFi matures, it is expected to introduce a range of innovative financial products and services. These developments may include more sophisticated smart contracts, enhanced decentralized lending platforms, and improved cross-chain interoperability. Such innovations will likely elevate user experience, making DeFi more accessible and secure for both retail and institutional investors.

Experts predict that DeFi will play a significant role in democratizing access to financial services. By eliminating intermediaries, DeFi can offer lower transaction fees, expedited processing times, and broader access to global markets. This democratization can be particularly transformative for underserved populations, providing them with crucial financial tools and fostering economic inclusion.

However, the road ahead is not without challenges. Regulatory scrutiny is expected to intensify as DeFi continues to grow. Governments and financial regulatory bodies are increasingly focusing on establishing frameworks to mitigate risks associated with fraud, money laundering, and consumer protection. These regulations, while potentially restrictive in the short term, could contribute to establishing a more stable and trustworthy environment for DeFi in the long run.

Technological innovation is another critical area for DeFi’s future growth. Enhancements in blockchain scalability, security protocols, and user interfaces are essential for accommodating the exponential increase in users and transaction volumes. Initiatives like Ethereum 2.0 and other layer-2 solutions are paving the way for more efficient and scalable blockchain architectures.

Industry leaders are optimistic about the long-term viability of DeFi. According to a recent analysis by blockchain researchers, the total value locked (TVL) in DeFi platforms is projected to grow exponentially over the next decade, potentially reaching trillions of dollars. This growth is likely to attract traditional financial institutions, creating opportunities for hybrid finance solutions that leverage both centralized and decentralized systems.

The future of DeFi seems poised for dynamic evolution, marked by technological innovation, increased adoption, and regulatory developments. As these elements converge, DeFi could fundamentally reshape the global financial landscape, offering unprecedented opportunities and challenges.

هذا جميل جدا

Interesting